Trusted accounting services in Hong Kong

All-in-one accounting services to keep your business a step ahead. Fixed monthly pricing, automated bookkeeping, timely audit and tax filing to ensure you stay compliant.

reviews: 4.9/5

Why outsource accounting services to Sleek?

Expert accountant

Get a dedicated accountant to reconcile your accounts, prepare your financial statements, balance sheet and more.

Timely and compliant

Keep track of your filing deadlines year-round and ensure you remain compliant and on top of your submissions for filing tax returns.

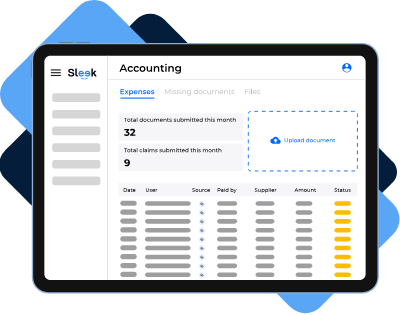

Paperless bookkeeping

Say bye to paperwork. Send us your receipts and documents electronically. They will be stored digitally. Accessible at any time, all in one place.

No surprises

Transparent, all-inclusive pricing that covers all your business needs, avoiding surprises and penalties.

All inclusive plans with fixed pricing

Save time and money with automation and our dedicated accountant services. To find the right fit, consider your average monthly expenses when selecting the plan.

MOST POPULAR

Accounting Starter

HK$250/mo

Accounting Growth

HK$490/mo

Accounting Success

HK$1,260/mo

Bookkeeping

Annual

Monthly

Weekly

Accounting

Payroll

Xero subscription

HK$3,880 / financial year

HK$3,880 / financial year

Included

Support response time

5 days

48 hours

24 hours

Want some add-ons? Build your own package →

Need more information before choosing?

Add-on essentials for complete accounting services

Financial audit

Audits are mandatory for all Hong Kong Limited Companies by the Hong Kong Inland Revenue Department (IRD), even for operations outside Hong Kong. For the tax filing, the signed audited financial statement and tax computation must accompany the Profits Tax Return.

CFO services

Audits are mandatory for all Hong Kong Limited Companies by the Hong Kong Inland Revenue Department (IRD), even for operations outside Hong Kong. For the tax filing, the signed audited financial statement and tax computation must accompany the Profits Tax Return.

Leave your accounting worries to Sleek

Annual tax filing

We will help you stay timely and on top of your tax returns so you will never miss them.

Paperless accounting

Snap a picture of your receipts on the go and we will take care of the rest for you.

Accurate reports

We will reconcile your accounts and prepare your financial statements, balance sheet and more.

Easy payroll

We run your payroll on time and take care of annual leave, medical leave, and everything in between.

Switch your accounting services to Sleek effortlessly

1

Fill in

your company details

2

Select

a plan and pay online

3

Submit

documents for approval

Sit back

and relax!

What our customers say about us

Friedrich Ackermann

Caseus Limited

Sleek have been my company’s accountants and company secretary for years now. Yuk-Ming, Vienna and their teams are absolute pros at what they do – extremely reliable, highly knowledgeable, responsive and friendly. I’m convinced that Sleek is the best provider of its kind in Hong Kong and of top of that prices are affordable.

Myriam Tzinmann-Rebibo

Mimi et lulu Limited

I was living hell with my previous accounting firm – Sleek has been taking over very quickly and has been on top of every single detail On-boarding has been very easy. Their response time and the quality of service has been impressive! They have taken the time to respond to all the question in a record time and reassure me. I would definitely recommend them!

Adam Bishop

NewCo Health Limited

Sleek is transforming company secretarial and accounting support, excellent tech and highly responsive and competent customer support. Light years ahead of other firms that I have previously used, in Hong Kong and beyond. A pleasure to be a client.

Dr. Bjoern Lindemann

ALINATA LIMITED

The combination of professional business services, fast customer communication and competitive pricing makes Sleek a great company to work with. Highly recommended.

FAQs

Here are some common questions we receive from our customers.

If you have any additional questions, please don’t hesitate to contact us.

As a small business or startup owner, outsourcing accounting services offers numerous benefits. By delegating bookkeeping tasks to experts, you can prioritize your core products and services while enjoying a full accounting department experience. From daily accounts receivable and accounts payable to payroll, transaction coding, Profits Tax Return filing, and financial reporting, outsourcing provides comprehensive support for your business’s financial needs.

SleekBooks is our proprietary accounting software solution designed to record company transactions in a compliant manner. With features such as multi-currency accounting, P&L and balance sheet reports, and a comprehensive audit trail, SleekBooks ensures a seamless experience. Our tools recognize and reconcile invoices and receipts, update documents and outstanding bank balance daily, support single and multiple currencies, provide a clear list of unpaid invoices, and alert you to any missing documents for accurate reporting.

If you need regular access to modify entries, automated invoice creation, integration with third-party cloud apps, and the ability to access reports and accounts on the go, we recommend opting for a Xero subscription. Xero offers these features along with the convenience of their mobile app.

Cloud accounting, also referred to as online accounting, involves hosting accounting software on remote servers, shifting the entire process to a cloud-based system while retaining the same functionality as desktop accounting. This approach is akin to the PaaS (Platform-as-a-Service) business model, where data is sent to a separate location for processing before being returned to the user or client.

One of the key advantages is that users can access software applications remotely through the Internet or Intranet. In the context of a Hong Kong accounting firm, employees from various departments can access the same up-to-date data and software version without missing any updates. Additionally, cloud accounting software eliminates the need for individual desktop installations and maintenance, providing businesses with real-time reporting and visibility.

Moreover, most cloud platforms offer API functionality, enabling third-party software to connect with your system and provide additional value to your business accounting processes.

You can submit your data in any format that is convenient for you. Simply drop your files in our app, store them in a cloud, or email them to our experts, and they will handle the rest with utmost care.

Tax filing requirements for companies include submitting the Profits Tax Return annually. Newly incorporated companies receive their first Profits Tax Return after 18 months of incorporation, and three months are given to prepare the accounts and audit report for the initial filing. The subsequent tax returns should be filed before the deadline based on the Company’s Accounting Year End Date.

Additionally, companies that have hired employees must file the Employer’s Return of Remuneration & Pensions annually. This report should include the salary and wages paid to employees for each fiscal year (April to March) and is typically submitted in April every year.

When your business is ready to scale and grow, it’s crucial to delegate routine administrative tasks like accounting and bookkeeping to trusted experts who understand the challenges of entrepreneurship.

At Sleek, we provide comprehensive accounting services for small businesses in Hong Kong. Our dedicated team prepares financial statements, handles bookkeeping, and offers expert accounting advice. By entrusting your accounting to us, you’ll save valuable time and avoid costly late fees or penalties, ensuring compliance with local authorities.

With Sleek, you not only receive the expertise of dedicated accountants but also gain convenient access to all your documents and financial data through our user-friendly app. Your documents are securely digitized and stored in the cloud, allowing you to work from anywhere you choose.

Maintenance of account books to help with the smooth running of the company. It is a record of year-round entries for the financial year, including profit and loss statements, balance sheet, ledger accounts, account receivables and payables, and bank reconciliation statements. Our SleekBooks accounting solution will help automate a lot of these processes to help you save time and money.

All Hong Kong-incorporated companies must maintain proper account books to comply with the Hong Kong Companies Ordinance.

Unaudited financial statements provide an accurate picture of a company’s financial health. Unaudited financial statements include: – Balance Sheet – Profit or loss Statement (P&L).

Employer’s Returns are tax filing forms, known as IR56B, submitted by employers to report employees’ and directors’ income information. It includes details on salaries, bonuses, allowances, deductions, and exemptions. Submission is required by April-end annually, aiding tax calculation and ensuring employee tax compliance.

Sleek’s payroll services include: One time set-up of the company payroll profile in Talenox Monthly Payroll Run, sending of Reports and Payslip Expense claims reimbursement to be added on payroll with the help of DEXT Employees access to the Talenox payroll software for payslip viewing MPF monthly e-submission (applicable to HK based employees) IR56B Employer’s Return for the tax assessment period of 01 Apr – 31 Mar Upgrade available for an extended version of Talenox which include: Leave Management System IR56E for new employee IR56F/G for resigned employee.

Outsourcing accounting services can help companies save cost and headcount, especially if they are small in size. At Sleek Hong Kong, we use trusted accounting softwares such as Xero and ReceiptBank to assist in our accounting services by recording your expenses and tracking your business transactions. Our team also utilises cloud accounting to ensure that your annual financial statements and audit work are up-to-speed! Individual year end reports and annual tax returns submission will be filed during the filing dates to the Hong Kong Inland Revenues Department. Your designated accounting manager or certified public accountant in Hong Kong will be in constant communication for any issues regarding the accounting service such as financial reporting and important information updates.

However, there are things to consider if you wish to get an external auditor/ accountant to settle your accounts. Click here for more information about picking an external auditor.

You can also check our article about HKAS.

We are dedicated to bringing our clients different levels of accounting services and bookkeeping based on their companies, office and business requirements. We can assure you there are no hidden fees in our services. Please refer to our pricing table and documents above for additional details on our accounting services. Each price range caters to different levels of company expense, starting at HKD 3,000 per financial year for companies with less than HKD 15,000 in monthly expense. Contact us and visit our site today for advice or tailor make your plan that’s most suitable for your business.

Want to know more about annual returns? You can find it here.

Auditing for Hong Kong companies is a mandatory requirement before tax submission is made in accordance with the Hong Kong Inland Revenue Department. Apart from our accounting services, Sleek is also experienced in offering auditing services for companies of various sizes and status. Subscribe to the accounting and bookkeeping plan to prepare for an easy and organised audit later on.

Sleek is experienced and dedicated to helping our clients and their companies indicate offshore profit taxation exemption claims in their tax return to the Hong Kong Inland Revenue Department. However, Sleek will not be able to cover clients in answering any immediate, or after period questions from the Hong Kong Inland Revenue Department regarding the specific documents and details on the status of the company on a monthly quarterly basis.

*Sleek will review the average expense level and adjust the pricing accordingly. Message us to find out more or check out our audit page.

Our accounting plan can grow with your company when needed, you’ll only need to pay the difference. Once the company’s financial year end is completed, Sleek will review the Avg expense level and adjust the pricing accordingly.