Top-rated company registration services in Hong Kong

Register your company 100% online in Hong Kong. Fast incorporation, easy process, expert support.

Incorporating from overseas? Explore our international packages designed for individuals residing outside of Hong Kong.

![]()

![]()

4.9/5

Check if your company name is available here

Effortlessly register your company in Hong Kong

Ridiculously simple

Fast, online, and hassle-free company incorporation. No need for any paperwork or for you to be physically present in Hong Kong.

No hidden fees

No surprises! Transparent, affordable, all-inclusive pricing. Solutions tailored to your business needs.

Expert support

Direct access to our experts who will guide you through each step of the company formation in Hong Kong with complete transparency.

Free Business Account

Get an Airwallex multi-currency business account with a VISA corporate card when you register your business with Sleek.

Incorporating from overseas? Explore our international packages!

Guaranteed satisfaction or get your money back.

Choose a plan that best suits your needs

Incorporating from overseas? Explore our international packages designed for individuals residing outside of Hong Kong

MOST POPULAR

Starter

HK$5,299

Grow

HK$8,299 HK$6,299

Grow

HK$8,299 HK$6,299

Select your package:

Buy Starter

Buy Grow

Buy Success

HK$3,999 government & incorporation fees

Company Incorporation

Company Secretary

Accounting & Bookkeeping*

Audit & Tax

Registered Address & Virtual Mailroom

Want some add-ons? Build your own package →

Need more information before choosing?

Before you incorporate your company in Hong Kong

Identify the business type

This information is required for proper classification and registration purposes.

Register your company name

Check if your company name is available using our online name checker.

Identify your company directors and shareholders

Directors of a company in Hong Kong are not required to be shareholders. A Hong Kong Private Limited Company can have up to 50 shareholders (excluding employees/former employees).

Allocate your paid-up capital

Determine the initial capital shareholders will contribute. In Hong Kong, except for regulated industries, there’s no minimum requirement for share capital, allowing incorporation with just HK$1.

Get a registered address in Hong Kong

You need a physical address in Hong Kong as the registered office for official correspondence and legal purposes. It must be a non-PO Box address capable of receiving all government communication and notices.

Appoint a Company Secretary

Every company must appoint a Company Secretary who resides in Hong Kong. This individual will help the directors to prepare and file all necessary documentation to keep the company compliant.

Swift, hassle-free, online company registration with Sleek

We will prepare all the documents you need for company registration. We will:

Provide your company constitution and compliance corporate kit

File your company registration

hare the incorporation document from Companies Registry

Don’t worry, our experts will guide you through each step of company formation with complete transparency.

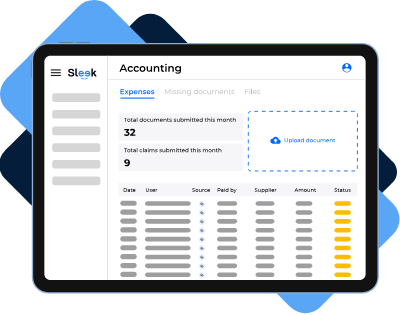

We also manage accounting for your business

Our user-friendly accounting platform is tailored for small businesses, simplifying expense management, payments, bookkeeping, financial reporting, and tax filing. Find out more →

What our customers say about us

Jehu Molina

The Banyan Tree Limited

Sleek is the most straightforward, fast and easy way to set up your business. The team is fast in responding and helpful at all times. It’s been a great decision and an excellent value for money. Strongly recommended.

Finn Stolle

LF Digital Solutions Limited

Sleek offers me the easiest company set up I have ever done! I have now created multiple Companies in three different Countries and this was by far the best experience. I would give 10 stars if possible!

Daniel DE LEON

Garuda Gear Limited

Great, easy to work with, amazing experience. We are not form Hong Kong so the help sleek provided for us was stellar. Incorporating in HK was so amazingly simple with them I was shocked. Highly Recommend!

Jay Ahn

Teach For Hong Kong Limited

If you are a small business owner, or any business owner based in Hong Kong, needing an auditor, filing taxes, having a business address, annual secretary filing, and want a very streamlined process at fair price points, I highly recommend Sleek.

Ready to start or still have questions?

Contact Us

Book a call with an expert

FAQs

Here are some common questions we receive from our customers.

If you have any additional questions, please don’t hesitate to contact us.

How do I incorporate my business in Hong Kong?

Company formation in Hong Kong is simple with these steps. You first have to decide on your type of business entity (i.e. company type) and company name. A quick search through the Companies Registry will show if your intended name is in use or not. The minimum requirement for Hong Kong companies are at least one shareholder, minimum $1 HKD of share capital, a company secretary that resides in Hong Kong and a local office address. After completing the name search and confirming the rest of the information, there is a list of incorporation forms and copies to submit along with your application through e-registry to the Hong Kong Companies Registry and Business Registration Office.

The entire registration process via an e-form, depending on the applicant’s experience and credentials, could take up to 7 to 14 working days to receive your certificate of incorporation.

For an in-depth guide, check out our guide on “How to register a business in Hong Kong“.

Why choose Hong Kong as a place of business?

Incorporating in Hong Kong is a strong choice when deciding where to base yourself. Hong Kong is a great place for business, with many investors being attracted to the location and the reason is clear. The tax-friendly environment is a big attraction for foreign businesses keen to start a business in Hong Kong. A productive legal system, and pro-business setup are some other factors that offer plenty of lucrative opportunities for businesses, besides an attractive tax regime and productive workforce. Stable economy, strong workforces, and business-friendly tax policies let you get up and running sooner- so you can spend less time tangled in admin and more time to invest in business activities.

Click here to find out more about the benefits of incorporating in Hong Kong.

How much does it cost to register a company in Hong Kong?

The majority of service providers in the industry will charge you for each step of the registration service. Additionally, many providers in Hong Kong do not offer transparent pricing.

At Sleek, we offer transparent pricing and charge HKD5,299 (including government fees) for our one-stop services that ensure full compliance. The fee includes an admin fee of HKD129,a government fee of HKD3,870, a Company Secretary Fee of HKD1,300, and an HK Registered Address Fee of HKD1,500.

We are pleased to provide support throughout the registration process.

Can foreigners start a business in Hong Kong?

Yes! Any one who has completed the Know Your Customer records checking process will have the rights to register Hong Kong companies and enjoy the financial benefits as a local company. However, the Companies Ordinance and Companies Registry CR will require your firm to have a registered office address, verified company name and a company secretary based in Hong Kong.

Read here for more information on liability, director, shares distribution and what information we need from you for the company registration and Hong Kong Companies e-Registry!

Can foreigners open a bank account?

It is very important for each new company in Hong Kong to have a business account. There are 2 approaches to opening an account in Hong Kong and many choices – either with traditional banks such as DBS or online financial services such as Transwap and Airwallex. Both approaches vary slightly as traditional banks value in-person meetings and more completed documents in the business registration process. Whereas for online financial services, you can fill in the information on their website and go through the process online. Both options have their own pros and cons. Read here for more details.

Sleek have many banking partners that can help with your business needs. Contact a team member today for referrals and email recommendations.

What is Business Registration Certificate?

The Business Registration Certificate is a document issued by the Business Registration Office showing details of a company. Businesses operating in Hong Kong require a Business Registration Certificate and Business Registration Number. If you have a business in Hong Kong, you are required to apply for a Business Registration Certificate within 30 days of commencing operations. This number is issued by the Inland Revenue Department (IRD) and the Companies Ordinance.

In order to keep operating as a business and protect the associated assets/shares, the certificate needs to be renewed annually. You may apply for the relevant documents via the e-Registry at the Hong Kong Companies Registry. Read a relevant article here.

What is a Business Registration Number?

Business registration number is the Tax Identification Number (TIN). BRN is a unique number assigned to a business by the Inland Revenue. The Business Registration number comprises 8 numerals at the front of business registration certificate number (e.g. 99999999-&&&-&&-&&-&). All the numerals of the Business Registration number are used as the identifier equivalent to TIN for entities.

What is the difference between BRN and CRN in Hong Kong?

The BRN consists of the initial 11 digits from the business registration certificate number, while the company registration number is a 7-digit figure. You can find this 7-digit number in the upper left corner of the Certificate of Incorporation. Read more here.

What is Articles of Association?

Articles of Association are a company document which sets out the rules and guidelines of how the board can operate the company. It is often viewed as a contract between company members and the company.

How often do I have to renew business registration?

For registered business, its Business Registration Certificate has to be renewed annually (unless it is a certificate for 3 years). The business registration office will usually send the business registration renewal demand note by post to the business address approximately in the middle of the month preceding the commencement month of the renewal Business Registration Certificate.

For example, if the renewal Business Registration Certificate will commence in May, the Business Registration Office will issue the demand note in mid-April. Upon payment, the demand note will become a valid Business Registration Certificate. If you do not receive such a demand note, you should inform the Commissioner in writing within 1 month of the expiry of your current Business Registration Certificate.

The renewal can still be done either in person or by post as follows:-

- In person – you should visit the Business Registration Office with your old Business Registration Certificate and request a fresh demand note. If your business address has changed but the Business Registration Office has not been advised, you should also complete the form IRC 3111A to notify the change.

- By post – you should send a photocopy of your old Business Registration Certificate with a crossed cheque made payable to “The Government of the Hong Kong Special Administrative Region” to the Business Registration Office. A receipted Business Registration Certificate will be posted to your business address soon afterwards. If your business address has changed, you should also attach an advice of the new address specifying your business registration number, business name, old and new business address or registered office address, and the date of change.

With effect from 14 February 2011, all renewal demand notes will be issued in plain A4 size paper. For further details, please refer to “Format of Business Registration Certificates, Branch Registration Certificates and Renewal Notices”.

Which other permits of licenses do I need?

Apart from BR, you may also need to apply for other types of licences or obtain the recognised professional qualifications for operating certain kinds of business.

Please visit the website of the Trade and Industry Department for information on other licences, permits, certificates and approvals relevant to import and export operations and other business operations in HK.

Can you register your company online in Hong Kong?

Absolutely, you can! Sleek’s streamlined online company registration process requires minimal effort on your part. We’ll assist you in arranging the appointment of a local Corporate Secretary, securing a registered address, setting up a business bank account, and various other tasks, all without the need for you to be physically present.

Can a foreigner be a director in Hong Kong company?

Yes. There is no requirement under the Companies Ordinance that a director must be a Hong Kong resident.

How long does it take to set up a Hong Kong company?

The company registration process typically takes 2-4 business days once all your documents are in order. The timeline primarily hinges on the readiness of your required documents and the operating hours of the relevant authorities.

What are the minimum requirements for registering a company in Hong Kong?

The most common choice for business registration in Hong Kong is the private limited company structure, which entails the following prerequisites:

-

A minimum of one shareholder, aged 18 or above, who can be either a local or a foreign individual.

-

At least one director, aged 18 or above, who may also be a local or foreign individual.

-

A single person can serve as both shareholder and director.

-

A registered address within Hong Kong is mandatory for the company’s establishment.

-

The minimum paid-up capital per share is HK$1. You also need a physical address in Hong Kong as the registered office for official correspondence and legal purposes. It must be a non-PO Box address capable of receiving all government communication and notices.

Finally, every company must appoint a Company Secretary who resides in Hong Kong. This individual will help the directors to prepare and file all necessary documentation to keep the company compliant.

Does a Hong Kong company need a resident director?

Hong Kong company directors aren’t obligated to be residents, and physical presence in Hong Kong is often unnecessary during the incorporation process. To register a Hong Kong Private Limited Company, you must have at least one director and one shareholder, with the option for a single individual to assume both roles.

What documents do you get after registering a company in Hong Kong?

After the incorporation process, business owners will receive a green box containing essential documents like Articles of Association, Statutory book, Share Certificates, Certificate of Incorporation, Business Registration Certificate, and Company Chops. These documents hold significance and require regular updates. The subsequent steps after company formation often involve obtaining relevant licenses and opening business bank accounts. Having a clear understanding of the process in advance enables early preparation and smooth success. Read more here.