Expert company incorporation services in Singapore

Register your business 100% online in Singapore: Fast, Simple, and Reliable.

![]()

![]()

4.6/5.0 on Google Reviews

Why choose Sleek for Singapore company incorporation?

Fast and simple

Complete application for incorporation of company in 30 min

Expert support

Our team will guide you through the incorporation process

Transparent pricing

All-inclusive plan with no hidden fees, no surprises

100% online

Incorporate your company from the comfort of your home

One-stop-shop

Start, stay compliant and manage your business easily

- Incorporating from overseas? See our foreigner incorporation page

How to register a company in Singapore

Made simple with Sleek!

1

Choose a company name

2

Select your services

3

Fill up the form –

we’ll take care of the rest

Trusted by over 450,000 businesses globally

Check if your company name is available here:

Satisfaction guaranteed or get your money-back Learn more.

How to register a company in Singapore

Save time & money with our hassle-free services. Register your sole proprietorship or private limited company today

Register in minutes | 100% online | Transparent pricing | First-class support

- Incorporating from overseas? See our foreigner incorporation page

Starter

Incorporation, and Unlimited Corporate Secretary for 1st year

Perfect for entrepreneurs that want to set up their business quickly with all the required compliance and governance essentials.

From

S$650

ncluding S$375 govt fees

Incorporation

-

Full registration on Company Registry (incl. $315 of govt fees) -

Provision of Company Constitution (memorandum & articles of association) -

All post incorporation documents (e.g. share certificates, registers, and minutes book)

Unlimited Corporate Secretary

-

Preparation & filing of annual return (incl. S$60 Government fees) -

Appointment of Company Directors/Company Secretary/Auditors -

Resignation of Company Directors/Company Secretary/Officers -

Change in officers’ particulars

For Company Secretary:

- Strike-off: S$500

- Other ACRA filing fees and penalties

- For the preparation of any legal documentation outside of the above scope and any related board resolutions to enact these changes, we will be happy to connect you with our legal partners to support you.

Essentials

Incorporation, Unlimited Corporate Secretary for 1st year, and Singapore registered address

Start a business, stay compliant with all the required compliance and governance essentials, complete with a Singapore registered address.

From

S$950

Including S$375 govt fees

Incorporation

-

Full registration on Company Registry (incl. $315 of govt fees) -

Provision of Company Constitution (memorandum & articles of association) -

All post incorporation documents (e.g. share certificates, registers, and minutes book)

Unlimited Corporate Secretary

-

Preparation & filing of annual return (incl. S$60 Government fees) -

Appointment of Company Directors/Company Secretary/Auditors -

Resignation of Company Directors/Company Secretary/Officers -

Change in officers’ particulars

Unlimited Corporate Secretary

-

A prestigious CBD Singapore registered address for your company -

A digital mailroom where your mail is scanned and uploaded for your review -

Securely store your mail and easily access it from any where and any time

For Company Secretary:

- Strike-off: S$500

- Other ACRA filing fees and penalties

- For the preparation of any legal documentation outside of the above scope and any related board resolutions to enact these changes, we will be happy to connect you with our legal partners to support you.

Full Compliance

Incorporation, Unlimited Corporate Secretary, Business Account and Accounting services for 1st year

Ideal for small businesses that want full compliance with straightforward accounting services. Never miss a deadline!

From

S$1,226

ncluding S$375 govt fees

Incorporation

-

Full registration on Company Registry (incl. $315 of govt fees) -

Provision of Company Constitution (memorandum & articles of association) -

All post incorporation documents (e.g. share certificates, registers, and minutes book)

Unlimited Corporate Secretary

-

Preparation & filing of annual return (incl. S$60 Government fees) -

Appointment of Company Directors/Company Secretary/Auditors -

Resignation of Company Directors/Company Secretary/Officers -

Change in officers’ particulars

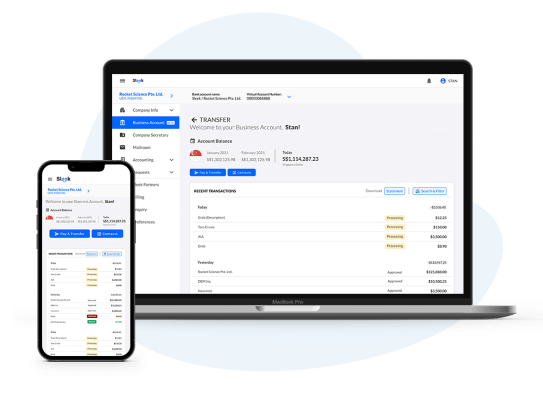

Sleek business account (subject to approval)

-

Opening of an SGD business account -

No deposit, or monthly fees -

Simple transfers (local and international) -

Change in officers’ particulars

Accounting and tax

-

Set up & onboarding -

WhatsApp & digital receipt submission -

Tax support -

Multi-currency support -

Sleek accounting software

For Company Secretary:

- Strike-off: S$500

- Other ACRA filing fees and penalties

- For the preparation of any legal documentation outside of the above scope and any related board resolutions to enact these changes, we will be happy to connect you with our legal partners to support you.

Frequently Asked Questions

Here are some common questions we receive from our customers.

If you have any additional questions, please don’t hesitate to contact us.

What’s required?

How to incorporate a company in Singapore?

Incorporating a company in Singapore involves these steps. First, choose a unique name and ensure it complies with regulations. Next, appoint directors and a company secretary who must be Singapore residents. Third, provide a registered office address in Singapore. Fourth, decide on the company’s shareholders and their respective shares. Fifth, submit the incorporation application through BizFile+ to the Accounting and Corporate Regulatory Authority (ACRA). Pay the necessary fees and obtain the Certificate of Incorporation once approved. Lastly, complete post-registration tasks like opening a corporate bank account and fulfilling tax and regulatory requirements. Consider consulting professionals for seamless incorporation.

How to incorporate a company in Singapore?

Incorporating a company in Singapore involves these steps. First, choose a unique name and ensure it complies with regulations. Next, appoint directors and a company secretary who must be Singapore residents. Third, provide a registered office address in Singapore. Fourth, decide on the company’s shareholders and their respective shares. Fifth, submit the incorporation application through BizFile+ to the Accounting and Corporate Regulatory Authority (ACRA). Pay the necessary fees and obtain the Certificate of Incorporation once approved. Lastly, complete post-registration tasks like opening a corporate bank account and fulfilling tax and regulatory requirements. Consider consulting professionals for seamless incorporation.

How do I incorporate my business in Singapore as a local?

Incorporating a company in Singapore is easy and straightforward. To set up your company, you are advised to: choose your business structure, register your company with ACRA and get a corporate bank account.

With Sleek’s help, you can complete all these steps in as little as one day and start your business from anywhere in the world, without needing any face-to-face meetings. Additionally, if you are not based in Singapore, Sleek can help foreign entrepreneurs apply for visas to legally own a company and stay compliant in Singapore.

Can foreigners start a business in Singapore?

Yes. Foreign entrepreneurs are welcome to begin their Singapore company registration process with either an Employment Pass, Dependant Pass with a Letter of Consent, ONE Pass, EntrePass or Personalised Employment Pass. The most common visa, Employment Pass, allows foreign professionals, managers and executives to work in Singapore. You will need to complete your company registration before applying for the employment pass and your application is subject to approval by authorities.

To avoid any hassle or uncertainty, foreigners are advised to hire a corporate secretary firm like Sleek, who can help clients with the whole incorporation process.

To avoid any hassle or uncertainty, foreigners are advised to hire a corporate secretary firm like Sleek, who can help clients with the whole incorporation process.

How do I check if a company is registered in Singapore?

It is super easy to check whether or not a company is registered in Singapore. Head to ACRA’s search platform and type in the company name that you would like to check. Right after that, if the company is registered, you will get the company’s information that would include – company name, office address, Unique Entity Number (UEN) and more.

Why is Singapore a good place to start a business?

Singapore is renowned for its stable jurisdiction, well-regulated economy, and robust financial infrastructure. Additionally, Singapore occupies a prime location in Southeast Asia and serves as an international hub.

Incorporating a company in Singapore has numerous advantages, including a business-friendly tax system that enables tax optimization. Singapore offers attractive tax rates and a plethora of tax incentives to promote entrepreneurship and business growth.

What are the key requirements to set up a new business in Singapore?

- At least S$1 paid up capital

- Local company secretary

- Singapore-based director

- A registered address in Singapore

Sleek can support each requirement to help you to get your company started.

What types of business structures are available for Singapore company incorporation?

You can choose between the following business structures:

Sole Proprietorship

Sole proprietorship essentially means there are no partners in the business. This means the owner can earn all the profits but also bears higher risk if anything happens. Sole proprietorship is not a separate legal entity from the business owner.

Who can apply:

Singapore citizens or permanent residents, Dependant Pass holders with a valid Letter of Consent (LOC), ONE Pass holders.

Partnership

Who can apply:

Singapore citizens or permanent residents, Dependant Pass holders with a valid Letter of Consent (LOC), ONE Pass holders.

Private Limited Company (Pte Ltd) – most popular structure

Private limited companies have: less than 50 shareholders and their shares should not be accessible to the public. A private limited company has the most flexible business structure. It is a separate legal entity from its shareholders and directors. It enjoys limited liability. We recommend the Pte Ltd structure due to its flexibility, legal protection and accessibility to government grants, funding and tax exemptions.

Who can apply:

Singapore citizens or permanent residents, Dependant Pass holders with a valid Letter of Consent (LOC), Employment Pass holders, EntrePass holders, ONE Pass holders, Personalised Employment Pass holders.

Limited Liability Partnerships (LLP)

LLP allows companies to operate as partnerships while enjoying the benefits of a private limited company. LLP are separate legal entities. Partners will not be held liable for any losses or debts from the business.

Who can apply:

Singapore citizens or permanent residents, Dependant Pass holders with a valid Letter of Consent (LOC), ONE Pass holders.

Gathering all the right information for your company registration could be the trickiest part, get in touch with Sleek if you need any assistance.

How much share capital do I need?

You only need $1 paid-up capital for your Singapore company registration, in any currency. The share capital can be increased any time after your incorporation.

How many shareholders do I need?

To incorporate your company in Singapore, you can have 1-50 shareholders. A shareholder can either be an individual or a corporate entity (also sometimes known as a “corporate shareholder”).

Singapore incorporated companies must have a minimum of one shareholder. This can be the same person as your local resident director. You can also add more shareholders at a later time.

You can also add more shareholders at a later time.

What is a corporate shareholder and do I need one?

A corporate shareholder is a business entity that owns shares in another limited company. The term ‘corporate shareholder’ may refer to another limited company, a limited liability partnership or a non-profit organisation or charity.

Who can I appoint as the director of my company?

You can appoint 1 or more directors for your company. Every company needs at least one local resident director (a Singapore Citizen or a Permanent Resident).

If they are Singapore citizens and/or Permanent Residents (PR)

They have to be individuals, and at least 18 years old.

If they are foreigners

If he or she is not a Singapore resident and wishes to fulfil the local resident requirements, the director must have a valid EntrePass or Employment Pass, and have a Letter of Consent (LOC) from Singapore’s Ministry of Manpower (MOM) to act as a Director (if applicable).

What is a corporate secretary?

A Corporate Secretary will keep your company on top of all the regulatory affairs. It is priced based on the number of shareholders (irrespective if they are individuals or corporate).

This role takes care of:

- Preparation & filing of annual return

- Appointments, resignations, & changes in particulars for directors, auditors, secretaries

- Distribution of dividends

- Maintenance of company records

- Overall compliance with local laws and much more

- Let Sleek handle your company secretarial services today.

What is the requirement for company secretaries?

Every Singapore company must appoint a secretary within 6 months of incorporation in Singapore.

A company secretary has to be an individual (and not an entity) and a local resident in Singapore.

Where can my registered address be?

All Singapore registered companies must have a registered address in the country.

It must be a place with a physical local address. A P.O. box is not accepted.

If you are living in Singapore, it is possible to use your home address as the registered office address if you participate in the Home Office Scheme with either URA or HDB. However, it is important to meet the specific criteria for using your home address and be aware that your permit can be revoked if those conditions are violated.

If you need a registered business address in the central business district area of Singapore, explore Sleek’s registered address and mailroom services.

What do I need to provide in order to incorporate my company in Singapore?

In order to incorporate your company in Singapore, you would need to provide:

Your company name for name registration

A brief description of your business activities

Details of your shareholders and directors, as well as their KYC (Know Your Customer) information

Gathering all the right information for your company registration could be the trickiest part, get in touch with Sleek if you need any assistance.

How much does it cost to incorporate a company in Singapore?

You can incorporate your business with Sleek at S$275. This excludes Singapore’s Accounting and Corporate Regulatory Authority (ACRA) fee of S$375.

What tax benefits do companies get for incorporating in Singapore?

Singapore offers many business-friendly tax benefits as incentives to encourage companies to register in the country.

New companies incorporated in Singapore can benefit from a generous startup tax scheme.

In terms of shareholding, shareholders of Singapore companies can enjoy 0% tax for both dividends and capital gains.

Singapore has also signed the Double Taxation Avoidance Agreements (DTA) with over 50 countries including China, Japan, Canada, France and the UK.

Singapore has a thriving investor community that facilitates raising investment.

All private companies in Singapore can be 100% foreign-owned.

The regulations and procedures for opening a bank account and other business operations are straightforward.

How do I check if a company is registered in Singapore?

It is super easy to check whether or not a company is registered in Singapore. Head to ACRA’s search platform and type in the company name that you would like to check. Right after that, if the company is registered, you will get the company’s information that would include – company name, office address, Unique Entity Number (UEN) and more.

ACRA is the Accounting and Corporate Regulatory Authority, a Singaporean government agency that oversees the registration and regulation of business entities in the country.

As an aspiring business owner in Singapore, you’ll need to register your business with ACRA before you can start operating. This process ensures that your business is compliant with Singapore’s laws and regulations, and it also allows you to access certain benefits and resources that are available to registered businesses.

ACRA also provides other services and resources for business owners, such as an online business portal to file annual returns and access various business resources.

Why do we need a Unique Entity Number (UEN) for companies in Singapore?

The Unique Entity Number (UEN) is an identification number issued by the Singapore government to all entities in Singapore. You will receive your UEN upon the completion of your Singapore company registration.

Entities that can get an UEN are local companies, LLPs, societies and representative offices.The Accounting and Corporate Regulatory Authority (ACRA) is responsible for issuing an UEN to all the entities with limited partnership, limited liability partnerships, foreign companies and public accounting firms.

Incorporation process

How can I get my company name approved?

Your company name must be approved, before you can proceed with registering your company. We recommend having a shortlist of three name options in case your first choice isn’t available. Names can be reserved for up to 60 days.

How can I decide on the ownership structure of my company?

You would determine the shareholders and their respective ownership percentages by indicating it in your company incorporation documents. If incorporating a subsidiary in Singapore, the sole shareholder will be the existing local or foreign company. For a new venture, the shareholders will be you and any partners you may have.

What documents do I need to prepare to incorporate my company?

Are you an individual starting a company?

- It can be as easy as providing your passport and proof of residency that’s less than 3 months old.

Are you an existing company looking to have a Singapore entity?

- Certificate of Incorporation/Registration

- Business Profile/Certificate of Incumbency

- Group ownership structure chart

- Certificate of Appointment of Corporate Representative and/or Directors’ Resolution in Writing authorising the representative

How long does it take to incorporate a company in Singapore?

The application process in Singapore typically takes 1-2 working days, provided all necessary documents are in place.

However, the processing time may be longer if there are any issues or errors with the application or if additional information is required. It’s worth noting that the timeline for the incorporation process can also depend on the type of company being incorporated and the specific requirements involved. It might take a company with foreign shareholders or directors longer to incorporate due to additional compliance requirements. It’s recommended to seek professional advice from an incorporation expert to ensure a smooth and efficient process.

After incorporation

What happens after incorporating a business?

After incorporation in Singapore, the company is considered a legal entity and can start conducting business activities and hiring employees.

You will receive a Certificate of Incorporation.

ACRA will send an email notification confirming the registration of your company. This is your official Singapore Company Incorporation Certificate and will include your business registration number. If you want a hard copy of the certificate, you can make an online request to ACRA for S$50.

You receive a Business Profile (”Bizfile”).

ACRA will also provide the business profile of your new company for free. The business profile is the identity card of the company.

You are able to open a corporate bank account.

After you have successfully registered your Singapore business, you will be able to open a corporate bank account with any of the banks in Singapore.

How can I appoint a company secretary?

To appoint a company secretary in Singapore, the company must first ensure that the secretary meets the necessary qualifications and is a Singapore resident. The company must then submit the necessary documents, such as a Notice of Appointment of Company Secretary and Consent to Act as Company Secretary, to the Accounting and Corporate Regulatory Authority (ACRA). It is important to note that a company secretary cannot also be the sole director or shareholder of the company. If you need to appoint a trusted company secretary, let Sleek handle all your compliance needs today.

What are the legal compliances required for running a business in Singapore?

Running a business in Singapore requires compliance with several legal regulations.

Here are some of the key legal compliances that businesses in Singapore need to follow post-incorporation:

Business Licences: Depending on the nature of the business, some businesses may require specific licences and permits before they can operate in Singapore. These licences and permits can be obtained from the relevant government agencies.

Employment Laws: Singapore has a range of employment laws that businesses must comply with, including the Employment Act, the Work Injury Compensation Act, and the Retirement and Re-employment Act.

Taxation: Businesses in Singapore must register for and comply with the various tax laws, such as the Goods and Services Tax (GST), Corporate Income Tax, and Withholding Tax. If you expect your business’ annual turnover to exceed S$1 million, then you must register for Goods & Services Tax, or GST (also referred to as value added tax, VAT, in many countries). If you do not expect your business’ annual turnovers to reach S$1 million, you are not required to register for GST.

Data Protection: Under the Personal Data Protection Act (PDPA), businesses in Singapore must ensure that the personal data of their customers and employees are collected, used, and disclosed in accordance with the law.

Immigration: Companies in Singapore that hire foreign employees must comply with the Work Pass framework and ensure that their employees have the appropriate work permits and visas.

Intellectual Property: Businesses should be aware of the various intellectual property laws in Singapore, such as trademarks, patents, and copyrights, and take appropriate measures to protect their intellectual property.

How do I know if I need to apply for a business licence?

Whether or not you need to apply for a business licence in Singapore depends on the nature of your business activities. Certain industries, such as food and beverage and retail, require specific licences and permits.

For example:

Food establishments must obtain a Food Shop License from the National Environment Agency (NEA)

Retail establishments must register with the Accounting and Corporate Regulatory Authority (ACRA) and obtain a Central Provident Fund (CPF) account for their employees.

It is important to research the specific licensing requirements for your industry and ensure that all necessary licences and permits are obtained before conducting business activities. Failure to comply with licensing requirements may result in penalties or legal action.

How can I open a corporate bank account?

To open a corporate bank account in Singapore, you will need to provide the bank with various documents, such as your company’s certificate of incorporation, business profile, and the personal identification documents of the company’s directors and signatories. Different banks may have different requirements, and some may require a minimum deposit to be made. It is best to check with the bank directly for specific requirements.

Under Singapore law, it is no longer a legal requirement for companies to have a company seal. However, some companies may choose to use a company seal for certain purposes, such as executing documents or contracts. In such cases, the company seal must be used in the presence of a director or company secretary.

How much does it cost to operate a company in Singapore?

The cost of running a company in Singapore varies depending on the size of the company, the nature of its business activities, and its location.

Common expenses include: office rent, employee salaries, utilities, and business taxes.

The government has implemented various measures to support businesses, such as tax incentives and grants, which can help offset some of these costs.

What tax benefits and grants do Singapore-incorporated companies enjoy in Singapore?

Singaporean companies can tax incentives, such as a partial tax exemption on up to S$100,000 taxable income, with 75% of their first S$100,000 corporate profits exempted for the first 3 tax filing years, a 50% further tax exemption on up to S$100,000 taxable income, and can also enjoy further partial tax exemption for 8.5% tax rate on taxable income on up to S$100,000 per annum.

The government has also introduced various schemes to support businesses, such as the Productivity and Innovation Credit (PIC) scheme, which offers tax deductions or cash payouts for investments in innovation and productivity.

They can also apply for the Productivity and Solutions Grant (PSG), which funds productivity and innovation investments, including new technology and equipment adoption. This grant supports companies in enhancing their productivity and staying competitive. Sleek is a pre-approved PSG vendor, and eligible clients can get up to 70% of their yearly fees for accounting covered with this grant.

Visas

Do I need a visa to start a company in Singapore?

As a local:

No, locals do not need a visa to start a company in Singapore.

As a foreigner:

However, if you are a foreigner who wishes to relocate to Singapore to run your business, you will need to obtain the relevant work visa or pass, such as the Employment Pass (EP), Dependant Pass with Letter of Consent (LOC), ONE Pass, EntrePass or Personalised Employment Pass (PEP). The type of pass required will depend on your qualifications, work experience, and the nature of your business.

Can a work permit holder start a business in Singapore?

According to Singapore’s Ministry of Manpower (MOM) regulations, work permit holders in Singapore are not eligible to start a business on their own. If work permit holders wish to start a business, they would need to obtain approval from MOM and meet the eligibility criteria for the relevant work pass or visa. The type of pass required will depend on the nature of the business and the individual’s qualifications and experience.

Can I start a company if I am an Employment Pass (EP) holder?

Yes, as an EP holder, you are allowed to start a Private Limited Company in Singapore. However, you can only run the company that is sponsoring your Employment Pass.

I just lost my job, can I open a company in Singapore to keep my EP?

If you as an EP holder just lost your job, your EP will be cancelled. You will have a 30-day grace period to either find a new job and have your new employer apply for a new EP, or to leave Singapore.

If you intend to start a business to keep your EP, you will need to meet the eligibility criteria for the EntrePass, which is specifically designed for foreign entrepreneurs who wish to start and operate a business in Singapore.

How can I get a visa to move to Singapore if I start a new business?

Singapore’s Ministry of Manpower (MOM) also offers entrepreneurs an opportunity to obtain a work visa such as the Employment Pass or EntrePass once you have incorporated a company in Singapore. This opens the door for you to move to the country and manage business operations here. The process and requirements for each type of visa may vary, so you should check the specific requirements and application process.

Need help to get started? Get in touch

As featured in:

Get a free Sleek business account with any accounting package

Watch what customers have to say about Sleek

Amiya Patanaik

CEO & Co-Founder, Neurobit

“I recommend Sleek to almost all my entrepreneur friends. Whoever is starting a new company, I would say just go for it, one less thing to worry about.”

Navneet Kaur

Founder & CEO, Yours

“My company admin all managed in one place and I have one point of contact to make it super easy for me to manage it”

Shivam Mani Tripathi

Co-founder & CTO, Privyr

“I would highly recommend Sleek to any person starting a company, if they do not want to spend a lot of time on registering their company.”